When someone dies, support often arrives in the simplest ways people know: a meal at the door, a card in the mail, money sent quietly so the family can breathe. Now, for some families, that support also shows up as crypto—someone asks if they can send Bitcoin instead of writing a check, or a friend suggests adding a wallet address to a memorial page. If you’re the person trying to manage it, you may be carrying two heavy things at once: grief, and the responsibility to do this safely.

It helps to start with a practical truth: more families are encountering cremation and its related decisions than ever before. According to the National Funeral Directors Association, the U.S. cremation rate for 2025 is projected at 63.4%, with a long-term projection of 82.3% by 2045. And in the same dataset, NFDA reports a 2023 national median of $6,280 for a funeral with cremation (and $8,300 for burial with a viewing). Those numbers don’t tell anyone what to choose, but they do explain why families sometimes need support quickly—especially when timing, travel, and cash flow collide. The Cremation Association of North America similarly reports a 2024 U.S. cremation rate of 61.8%, reflecting how common cremation has become across regions.

In that context, it’s understandable that “help us cover expenses” can include a crypto donations funeral option. The key is to slow down just enough to make three decisions that prevent headaches later: what kind of donation this is (gift vs. charity), how you’ll custody and convert it, and what records you’ll keep for transparency and taxes. None of this needs to be perfect. It just needs to be defensible, secure, and kind to your future self.

First: Decide Whether This Is a Gift to a Family or a Charitable Memorial

Most confusion starts here, because crypto blurs the line between “money sent to support you” and “donation made in someone’s memory.” They are not the same, and the tax paperwork can be very different.

If the funds are intended to help a person or family directly—covering travel, rent, childcare, how much does cremation cost, or the costs of memorial items—then you are essentially accepting gifts. That might look like accept bitcoin donations for family through a shared wallet address or a crypto fundraiser wallet created for the immediate period after the death.

If the funds are intended for a qualified charity (for example, a hospice foundation, a scholarship fund, or a nonprofit the person supported), then you are facilitating charitable giving. That may mean directing donors to the charity’s official donation page, or setting up a memorial campaign that routes crypto directly to the charity (not to you personally). This is the path that most cleanly supports donors who want a tax deduction, because it can be documented as a charitable contribution under IRS rules.

This distinction matters emotionally, too. Families sometimes feel pressure to “account” for every dollar people give after a death. A gentle way to reduce that pressure is to name the purpose upfront: “Support for the family’s immediate expenses” versus “Charitable memorial fund.” People tend to respect clarity, and clarity tends to protect you.

Accepting Crypto Safely Without Becoming a Full-Time Crypto Administrator

If you’ve never managed digital assets before, you do not have to become an expert overnight. The goal is not sophistication. The goal is how to accept crypto donations safely in a way that reduces volatility risk, avoids custody mistakes, and supports clean recordkeeping.

Pick the simplest acceptable custody model

Broadly, you have two choices: custody it yourself or use a hosted solution. Self-custody means you control the private keys (typically through a hardware wallet or a non-custodial wallet app). Hosted solutions (custodial platforms) hold the crypto for you and often provide reporting tools, receipts, and an easier path to conversion.

For many grieving families, “simple and safe” tends to mean either (a) using a reputable hosted platform that allows quick conversion to U.S. dollars, or (b) using a self-custody wallet only if a trusted, crypto-literate person is truly available to manage it carefully. The IRS describes digital assets as property and emphasizes keeping records for transactions; regardless of custody, you want a workflow that supports that recordkeeping. See the IRS overview on digital assets.

Use controls that match the emotional moment

After a death, people are more vulnerable to scams, rushed decisions, and “I clicked the wrong thing” mistakes. If you are using self-custody, the best practice is to reduce the chance of a single misstep causing a loss. That usually means separating “public receiving” from “longer-term storage,” and limiting who can move funds.

If a short list helps, these are the controls families most often find useful:

- One public receiving address that you publish in official places only (obituary page, memorial page, a pinned social post from the family).

- A second, private storage wallet (often a hardware wallet) where you move funds periodically if you are holding crypto for more than a brief window.

- Two-person verification for outgoing transfers whenever possible (even if it’s informal, like “we both check the address on screen before sending”).

- A plan for conversion timing if you need cash for near-term expenses (volatility is not a moral failure; it is just part of the asset).

If you’re working through a platform, look for a workflow that lets you generate a clean donation log and convert to USD when needed, because many families are not trying to “invest.” They are trying to pay for a cremation, reimburse travel, or choose memorial items like cremation urns or cremation jewelry without adding financial stress.

Publish the address carefully and assume scammers are watching

Do not accept wallet addresses via random direct messages. Do not let friends “help” by sharing a different address unless you can verify it is truly yours. A common scam is an impersonator posting a look-alike address in comments, hoping donors won’t notice.

Practical steps that help: put the address in a place you control (a memorial page, a family-controlled website), include a QR code generated from that same address, and add a sentence telling donors that the family will never DM an address change. If you want a phrase that’s clear without being scary, you can say: “Please use the address exactly as listed here; we won’t request address changes via messages.”

Tracking and Documentation: What You’ll Be Glad You Saved Later

Crypto creates two recordkeeping needs at once. One is emotional and social—people want reassurance that funds were handled responsibly. The other is administrative—your accountant or attorney may need documentation for estate files or tax reporting. The IRS repeatedly emphasizes maintaining sufficient records for digital asset transactions. See IRS digital assets guidance, and foundational IRS treatment of virtual currency as property in Notice 2014-21.

When families talk about recordkeeping crypto gifts and estate crypto accounting, what they typically mean is a clean, exportable log that answers four questions: who sent it (if known), what was sent, when it was received, and what it was worth in USD at that moment.

To keep it simple, build a spreadsheet (or platform export) that includes the following fields:

- Donation date and time (with time zone)

- Asset type (BTC, ETH, etc.) and amount received

- Wallet address received into and transaction hash (or platform transaction ID)

- Donor name and email (if provided) and whether they want to be anonymous

- USD fair market value at receipt (and the source used to determine it, such as the platform’s quoted price)

- Disposition details (converted to USD, transferred to another wallet, or held), including dates, fees, and net proceeds

This is not busywork. This is how you avoid disputes and confusion months later—especially if a family member asks for a summary, if an estate attorney needs documentation, or if you decide you want a transparent update like “we received X total; here’s what we used it for.”

Taxes When Crypto Is a Gift to a Person or Family

The most important calming point is this: receiving a gift is not the same as earning income for services. People get nervous that “crypto equals taxable,” but the tax treatment depends on what the transfer actually is. If supporters are sending crypto to a family to help after a death, that is usually treated as a gift. The IRS has an example in its Gifts & Inheritances FAQs where the recipient does not need to report the transaction, but the donor may have reporting requirements as a taxable gift; see IRS Gifts & Inheritances FAQ.

What does that mean in plain language? It means the family receiving support typically isn’t paying income tax just because someone sent a gift. However, the person giving the gift may need to file a gift tax return if they exceed the annual exclusion amount. The IRS gift tax FAQs list the annual exclusion per recipient as $19,000 for 2026 (and $38,000 for married couples who split gifts). See IRS gift tax FAQs.

Two practical nuances matter for crypto:

First, valuation still matters. Even for gifts, you may want to document the USD value at the time you received it. That is helpful for transparency, and it becomes essential if you later sell the crypto and need to compute gain or loss.

Second, taxes may appear later when the crypto is sold or exchanged. The IRS treats virtual currency as property, so dispositions can trigger capital gain or loss. That is part of why many families choose to convert quickly if the money is intended for near-term expenses. Notice 2014-21 lays out the property framework, including the use of fair market value in U.S. dollars on the date of receipt for certain transactions. See IRS Notice 2014-21.

If you want a gentle, non-technical way to explain this to relatives, it can be as simple as: “We recorded the value when it arrived, and if we convert it later, we’ll keep that documentation too.” That’s often enough.

Taxes When Crypto Is Donated to a Charity “In Memory Of”

If the intent is to donate crypto in memory of someone to a qualified charity, a different set of rules applies—often with cleaner outcomes for donors who itemize deductions. The IRS has specific guidance for virtual currency charitable contributions, including how the deduction amount is generally determined based on holding period. See the IRS virtual currency FAQs on charitable contributions: Frequently asked questions on virtual currency transactions.

According to that IRS FAQ, a donor’s charitable contribution deduction is generally equal to the fair market value of the virtual currency at the time of donation if the donor held it for more than one year; if held one year or less, the deduction is generally the lesser of basis or fair market value. The IRS points donors to Publication 526 for broader charitable contribution rules.

Charitable giving also comes with substantiation requirements. For contributions of $250 or more, donors generally must obtain a contemporaneous written acknowledgment from the charity; see IRS guidance on written acknowledgments. This is one reason families sometimes prefer routing memorial giving through an established charity rather than “passing money through” personal accounts—because the charity can handle the donation receipt and acknowledgment in the standard way.

Where the paperwork becomes more specific is with noncash contribution reporting. Donors use Form 8283 to report certain noncash charitable contributions, and the IRS provides detailed instructions on when Section A vs. Section B is required. See Instructions for Form 8283 and About Form 8283. If you’re seeing phrases like IRS noncash contribution Form 8283 crypto, it’s usually because the donor’s total noncash gifts exceed the thresholds where Form 8283 becomes relevant, or because the value of the contributed property is significant enough to require Section B.

Importantly, the Form 8283 instructions state that items reportable in Section B (generally, property for which the deduction claimed is more than $5,000) require a written qualified appraisal by a qualified appraiser. That is why donors may ask about crypto donation appraisal 5000 when they contribute a larger amount. The details can be nuanced depending on the type of property and the donor’s facts, so the safest language for families and charities is: “Please consult your tax advisor; the IRS has specific Form 8283 and appraisal requirements for certain noncash contributions.” The IRS’s own explanation of Section B requirements is in the Form 8283 instructions.

If you are a charity accepting crypto, there are also reporting responsibilities on your side—especially if the charity sells the donated property within three years. The IRS addresses this in the virtual currency FAQs and through Form 8282, which donee organizations use to report dispositions of certain donated property. See About Form 8282.

When Crypto Is Part of the Estate (Even If You’re Not Trying to Be)

Sometimes crypto donations intersect with the estate in a way families do not anticipate. For example, supporters may send crypto to a wallet that belonged to the deceased person (because that is the address people already knew), or the deceased may have held crypto that the executor discovers after death. Even if your article is focused on incoming support, it’s worth naming this: digital assets can be estate assets, and access matters.

The IRS describes digital assets as property and includes them across multiple forms; see IRS digital assets guidance. For families, the immediate practical question is not tax theory—it’s access. If no one has the private keys or account access, the asset may be effectively unrecoverable. This is one reason digital asset instructions have become part of modern funeral planning, alongside more familiar items like beneficiary designations and document storage.

For executors who do gain access, valuation and basis can matter later if assets are sold. The IRS notes that basis for inherited property is generally tied to fair market value at the date of death (with certain exceptions and special rules). See the IRS Gifts & Inheritances guidance on inherited property basis and reporting: Gifts & inheritances, and the related basis discussion in Publication 551.

If you are receiving crypto support as a family, you can reduce future confusion by labeling the wallet clearly: “Family support wallet” versus “Estate assets wallet.” That simple separation can help keep gifts from being mistaken for estate property, and it can help an attorney reconcile records later.

Connecting Support to Memorial Choices: What Families Commonly Use Funds For

Even when money is tight, most families are not looking for extravagance. They are looking for a memorial that feels right and doesn’t create new stress. If crypto support is meant to help with memorialization, it can be helpful to point people toward options that match real use cases—especially when multiple relatives are involved and decisions happen over time.

If cremation is part of your plan, a common starting point is choosing a primary urn and then deciding whether smaller keepsakes make sense for sharing. Funeral.com’s collection of cremation urns for ashes is designed to support different plans—home display, interment, or later scattering—while your family sorts out what feels right. If you anticipate sharing, keepsake cremation urns for ashes (often described as keepsake urns) can be a gentle option, especially if not everyone lives in the same place.

Sometimes families prefer something in between—more space than a tiny keepsake, but not a full-size vessel. That is where small cremation urns for ashes can be the right fit, particularly when you want a second “home base” urn or a portion for a specific family member. If you want a calm explanation of sizing and how plans affect capacity, the Journal guide How to Choose a Cremation Urn walks through decisions in plain language.

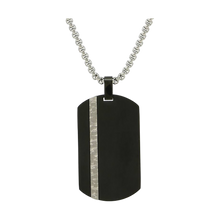

For many people, carrying a loved one close is not metaphorical—it’s physical. That’s why cremation jewelry has become part of modern memorial planning. If this option fits your family, you can browse cremation jewelry broadly or focus on cremation necklaces specifically. If you want guidance before buying, the Journal’s Cremation Jewelry 101 and Cremation Necklaces for Ashes articles can help you choose something that is comfortable, secure, and emotionally right—not just aesthetically appealing.

Families also ask about keeping ashes at home—not because they want to break rules, but because they want a sense of closeness while they decide what comes next. If that is your situation, Funeral.com’s guide on keeping ashes at home focuses on safe placement, respect, and the reality that your feelings may change over time.

And if your plan involves a ceremony with water—whether scattering or an urn that dissolves—families often search for water burial guidance and feel overwhelmed by conflicting advice. The Journal article Water Burial and Burial at Sea explains what terms mean in practice and how families plan respectfully.

These memorial choices are also where incoming support can feel most meaningful. People don’t always know what to do with their grief, and contributing toward a dignified memorial—an urn, a keepsake, a piece of cremation necklaces jewelry, or travel so someone can attend—gives them a concrete way to show up.

A Note on Transparency: Kindness and Clarity Can Coexist

If you are worried about judgment, misunderstandings, or family conflict, you are not being cynical. You are being realistic. The simplest protective step is to keep a short written “purpose statement” for the funds and a matching summary log. That’s true whether the support arrives as checks, Venmo, cash, or crypto.

For crypto specifically, a calm transparency practice is to provide periodic updates like: “We received support and used it for immediate expenses and memorial costs. We converted X on these dates for bills; we’re holding the remainder for future memorial decisions.” You do not have to publish every detail publicly. But you will likely feel steadier knowing the records exist.

FAQ: Crypto Donations After a Death

-

Is crypto sent to a grieving family considered taxable income?

Often, crypto sent to a family for support is treated as a gift rather than income for services. The IRS has guidance indicating the recipient generally does not need to report the gift transaction, though the donor may have gift tax reporting requirements depending on the amount and circumstances. For a clear example and donor filing triggers, see the IRS Gifts & Inheritances FAQ: Gifts & Inheritances 1.

-

Can donors deduct crypto they give to a family GoFundMe-style wallet?

Generally, gifts to individuals are not charitable contributions. If donors want a tax deduction, the crypto must be donated to a qualified charitable organization, and the donor must meet IRS substantiation requirements. For charitable contribution rules, see Publication 526 and the IRS guidance on written acknowledgments.

-

If a charity receives crypto “in memory of” someone, how is the deduction determined?

The IRS explains that a donor’s charitable contribution deduction for virtual currency is generally based on the fair market value at the time of donation if the donor held it for more than one year; if held one year or less, the deduction is generally the lesser of basis or fair market value. See the IRS virtual currency charitable contribution guidance in the virtual currency FAQs.

-

When does Form 8283 matter for crypto donations?

Form 8283 is used to report certain noncash charitable contributions, and the IRS instructions explain when Section A vs. Section B applies based on the amount and type of property. For the official thresholds and documentation requirements, see Instructions for Form 8283 and About Form 8283.

-

Do we have to convert crypto to dollars immediately?

No. But many families convert quickly if they need cash for near-term expenses because crypto prices can move sharply. Whatever you choose, keep records of the date received, the amount, and the USD value at receipt, and document any later sale or conversion. The IRS emphasizes keeping records for digital asset transactions; see IRS digital assets guidance.

-

What if someone sends crypto to the deceased person’s old wallet address?

This can become an estate administration issue, because the asset may be part of the decedent’s digital property and may require executor access. If you can, publish a single, verified receiving address for support so donors don’t guess. For general IRS context on digital assets and recordkeeping, see IRS digital assets guidance, and for inherited property basis concepts that can apply when assets are later sold, see IRS Gifts & inheritances.

Closing: A Practical Way to Let Support Be Support

After a death, people want to help, and families want to accept help without creating a mess. Crypto can be a meaningful option—especially for supporters who live far away or prefer digital giving—but it works best when you treat it like any other sensitive financial workflow: name the purpose, choose the simplest secure method, and keep records that you won’t dread looking at later.

If the support is meant to help you make memorial decisions, you do not have to rush. Many families start with a primary plan—choosing cremation urns for ashes or pet urns for ashes, selecting keepsake urns for sharing, or choosing cremation necklaces—and then revisit options like what to do with ashes or a future water burial ceremony when the first wave of shock has softened. Funeral planning is rarely one decision. It’s a series of small, human decisions that become a tribute over time.