In many families, the decision to choose cremation is less about a trend and more about practicality: it can be simpler to plan, easier for far-flung relatives, and flexible about when and where a memorial happens. Still, the broader shift matters because it shapes how funeral homes, crematories, and families approach timelines and costs. According to the National Funeral Directors Association, the U.S. cremation rate is projected to be 63.4% in 2025, and the burial rate is projected to be 31.6%. The Cremation Association of North America reports a U.S. cremation rate of 61.8% in 2024. Those numbers are not just trivia—they’re a reminder that more families are navigating the same core question you may be facing right now: “Can we use life insurance to cover cremation costs, and if so, how do we do it without delays and surprises?”

The short answer is yes, use life insurance to pay for cremation can work very well. The longer answer is that it works best when you plan for the timing gap between when bills come due and when how long does life insurance payout take becomes “soon enough.” In the early days of loss, you deserve fewer complications, not more. This guide walks you through the most common ways families use life insurance funeral expenses funding, the paperwork that tends to speed things up, and the pitfalls that can slow a claim or reduce the amount you actually receive.

The timing reality: cremation decisions happen fast, insurance pays later

When someone dies, a lot of decisions land all at once. Even with cremation—often viewed as a “simpler” option—there are still authorizations, permits, transportation, and coordination with the crematory. Families usually need to sign paperwork within days, sometimes within 24–48 hours depending on the circumstances and local requirements. That’s why the timing question matters so much: cremation planning tends to move quickly, while life insurance funeral expenses reimbursement can take longer than people expect.

On the claim side, insurers generally need a claim form and proof of death, and then they verify the policy and beneficiary information. A practical benchmark from Aflac is that life insurers typically take 14 to 60 days to pay out the death benefit after the beneficiary files a claim, though the timeline can vary based on documentation, the cause of death, and whether additional review is required. That range can feel painfully slow when a funeral home deposit is due this week.

There’s a second timing issue that shows up more often than families realize: sometimes you don’t have the policy information at all. If you are searching for coverage, the NAIC Life Insurance Policy Locator can help connect consumers to benefits, but NAIC notes those searches may take 90 business days or more to complete. That tool can be valuable—especially in estates where paperwork is missing—but it is not designed for “we need to pay for cremation next week.”

So, in real life, families usually use life insurance in one of two ways: they either pay first and get reimbursed, or they arrange for some form of direct payment to the provider through an assignment process.

Two practical ways families use life insurance for cremation

Paying upfront and getting reimbursed

This is the most common path because it is straightforward: the family pays the cremation provider (or funeral home) using available funds—savings, a credit card, help from relatives, or sometimes a small loan—and then uses life insurance proceeds to reimburse the person who covered the costs. It’s not glamorous, and it may feel unfair in the moment, but it is often the fastest way to keep decisions focused on what matters rather than on paperwork timing.

When families choose this approach, it helps to keep the financial side as clean as possible. Ask for itemized statements and keep receipts. If multiple relatives are contributing, consider one person paying the provider and others reimbursing that person later, so the paper trail is simpler when the insurance proceeds arrive.

It’s also helpful to understand what you’re actually covering. “Cremation” can mean different packages, and how much does cremation cost depends heavily on the type of cremation and the services included. NFDA reports that the national median cost of a funeral with a viewing and cremation was $6,280 in 2023. You can review that benchmark on the NFDA statistics page. Direct cremation (without a viewing or formal service) can be significantly lower, but pricing varies by region and provider model, so it’s wise to compare what is included rather than comparing only the headline number.

Assignment of benefits: directing payment to a funeral home

The second path is some form of assignment of benefits funeral home arrangement—sometimes described as assigning proceeds or assigning benefits—where the beneficiary authorizes the insurer to pay the funeral home directly for all or part of the bill. If done carefully, this can reduce the need for the family to pay out of pocket while waiting for the claim to be processed.

The key is understanding what an assignment is and what it is not. In many cases, an assignment is not “making the funeral home the beneficiary.” It is typically a direction from the beneficiary to the insurer about where some of the proceeds should be paid. That distinction matters because it affects who has authority, what paperwork is required, and how disputes are handled if multiple beneficiaries exist.

If you want a step-by-step explanation focused specifically on funeral funding, Funeral.com’s Journal has a dedicated guide: Assigning Life Insurance to Pay a Funeral Home. It explains common workflows, what to watch for with partial assignments, and why assignments can still be delayed if the claim itself is delayed.

One gentle caution: even when a funeral home accepts an assignment, the insurer still has to approve and pay the claim. If the claim is delayed due to missing documents, beneficiary questions, or a review period, the assignment does not magically speed up the insurer’s internal process. In other words, assignments can reduce the family’s upfront payment burden, but they are not a guarantee of immediate funding.

The documents that usually speed things up

When families feel stuck, it’s often not because the insurer is “dragging its feet,” but because something essential is missing or inconsistent. The fastest claims tend to be the ones where the beneficiary can submit a complete packet quickly and respond promptly to follow-up questions. The NAIC notes that to claim a benefit, you generally need a copy of the death certificate.

In practical terms, these items tend to help reduce avoidable delays:

- Certified death certificates (request multiple copies, since more than one institution may require an original or certified copy).

- The insurer’s claim form completed fully and consistently with the death certificate details.

- Policy information (policy number, insurer name, agent contact, or employer group coverage details).

- Beneficiary identification documents and any required proof of relationship or authority (especially if the beneficiary is a trust or an estate).

- A funeral home or cremation provider statement if you are requesting reimbursement for specific expenses or coordinating an assignment.

If you are coordinating an assignment of benefits funeral home arrangement, ask the funeral home what they need from you versus what they will submit on your behalf. Clarity here prevents duplicate submissions and confusion that can slow the process.

Common pitfalls that cause delays or smaller payouts

Most “surprises” with life insurance claims are not rare edge cases—they are common issues that simply don’t come up in everyday life until someone dies. Knowing them ahead of time can help you spot problems earlier and choose a funding path that keeps the cremation plan moving.

Policy lapses and coverage uncertainty

If premiums were missed, a policy may have lapsed, or employer-provided coverage may have changed when someone retired or left a job. Sometimes there is still a residual value, especially with certain permanent policies, but you do not want to build a cremation plan around an assumption. If you are unsure whether a policy exists or is active, the NAIC’s guidance on finding lost policies is a useful starting point, but remember that searching can take time, and immediate expenses may still need another plan.

Beneficiary complications

Beneficiary issues can slow claims when names are outdated, when a beneficiary has died, when there are multiple beneficiaries who disagree, or when minor children are involved. The NAIC explains that beneficiaries may have options for how they receive proceeds and that the insurer needs to confirm beneficiary status before paying. If your family is already navigating tension or uncertainty, it may be kinder to your future self to plan on paying upfront and seeking reimbursement later, rather than tying cremation funding to a claim that could become a longer process.

Policy loans that reduce the payout

This is one of the most painful “we didn’t realize” moments. If the policyholder borrowed against the cash value of a permanent policy and did not repay the loan, the death benefit can be reduced. The NAIC explains that any unpaid loans (plus interest) are subtracted from the death benefit. If you are using life insurance specifically to cover cremation costs, this matters because the amount you expected may not be the amount you receive.

Contestability and investigation delays

Many people have heard the phrase “contestability period” without knowing what it actually means until a claim is slow. In general, if a death occurs within a contestable period, insurers may review the application and medical history more closely before paying. Florida’s consumer overview notes that most policies contain an incontestability clause and that during the contestable period an insurer may review medical history before paying or denying a claim, which can create delays. See the Florida Chief Financial Officer’s consumer guide: Life Insurance Overview.

This does not mean your claim is “in trouble,” but it does mean that relying on a quick payout to cover near-term cremation expenses can backfire. If you suspect a claim might require extra review, it is often safer to separate “getting the cremation handled” from “getting the life insurance processed,” and then use the proceeds to reimburse expenses afterward.

Missing paperwork and inconsistent details

Small mistakes can have outsized effects. A missing death certificate, a mismatch in a name spelling, or an incomplete claim form can create weeks of back-and-forth. Even when the death benefit is clear, insurers still have compliance steps to follow, and they may not finalize payment until the documentation is clean. That’s why it can help to request multiple certified death certificates early and keep a single, consistent set of identifying details across documents.

Planning the memorial details while you wait: urns, keepsakes, and what to do with ashes

One quiet truth about cremation is that families often feel a second wave of decision-making after the cremation itself is complete. The practical question becomes what to do with ashes, and the emotional question is often, “What will make this feel real and respectful?” Life insurance can help cover these choices too, but you do not need to rush them while paperwork is still moving.

Choosing cremation urns for ashes with the final plan in mind

If you are selecting cremation urns or cremation urns for ashes, the best starting point is not the urn photo—it is the plan. Are the ashes staying at home for now? Will the urn be placed in a niche? Is the family leaning toward scattering later? Funeral.com’s Journal breaks this down clearly in How to Choose a Cremation Urn, and the Cremation Urns for Ashes collection is a helpful place to compare styles once you know what the urn needs to do.

Small cremation urns and keepsake urns for sharing

If more than one person wants a tangible connection, small cremation urns and keepsake urns can make sharing possible without turning it into a stressful negotiation. Funeral.com organizes these options in the Small Cremation Urns for Ashes and Keepsake Cremation Urns for Ashes collections, and the Journal’s Keepsake Urns 101 is a calming read when you want to understand sizes and seals without feeling rushed.

Keeping ashes at home

Many families choose keeping ashes at home—either permanently or temporarily while they decide on scattering or burial. If you are considering a home memorial, it helps to know what “safe and respectful” looks like in everyday life: stable placement, secure closures, and a plan for how the household will treat the space. Funeral.com’s Journal guide Keeping Ashes at Home is a practical companion, especially when different relatives have different comfort levels.

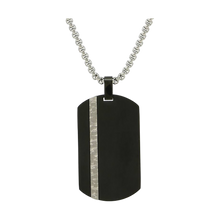

Cremation jewelry and cremation necklaces

Sometimes the most comforting choice is not a larger urn, but something small that stays with you. Cremation jewelry—including cremation necklaces—can hold a tiny portion of ashes as a daily, steady reminder. If you’re exploring this, the Cremation Jewelry and Cremation Necklaces collections are a practical starting point, and the Journal’s Cremation Jewelry 101 helps families understand what these pieces are, how they’re filled, and how they fit into the bigger memorial plan.

Water burial and scattering choices

If your family is thinking about water burial or scattering at sea, you will eventually want an urn that matches that plan. Some urns are designed to be kept; others are designed to be released. Funeral.com’s Journal explains these differences in Scattering vs. Water Burial vs. Burial, and the guide Water Burial and Burial at Sea walks through what families should know when planning the moment.

Pet urns for ashes and pet keepsakes

While life insurance is usually tied to a person’s death, many families are also navigating pet loss, and the emotional reality can be just as heavy. If you’re choosing pet urns or pet urns for ashes, Funeral.com’s Pet Cremation Urns for Ashes collection includes a wide range of designs, including pet cremation urns that feel traditional, artistic, or modern. For families who want something that looks like their companion, Pet Figurine Cremation Urns for Ashes can be a particularly meaningful path. And if you’re sharing ashes among relatives or households, Pet Keepsake Cremation Urns for Ashes can make that gentler. For a calm walkthrough, the Journal’s Pet Urns for Ashes guide covers sizing and common decisions in a practical, compassionate way.

A calm way to coordinate life insurance and cremation costs

If you are trying to make decisions while grieving, it can help to treat this like two parallel tracks: one track is funeral planning and getting cremation arranged in a way that feels respectful; the other track is the insurance claim process. They connect, but they do not have to depend on each other day-to-day.

In practical terms, many families find this sequence reduces stress:

- Confirm whether you have the policy information and who the beneficiaries are.

- Ask the provider what is due immediately, what can wait, and whether they accept an assignment process (and what paperwork they require).

- Decide whether you are paying upfront for reimbursement or pursuing an assignment for direct payment.

- Submit a complete claim packet as early as possible, using consistent details and enough certified death certificates.

- Choose memorial items like cremation urns, keepsake urns, and cremation jewelry with the final plan in mind rather than rushing under pressure.

If you are in the middle of this right now, try to be gentle with yourself: needing time, needing help, and needing a plan that works in the real world is not a failure. It’s what families do—one step at a time—when they are carrying grief and logistics at the same time.

FAQs

-

How long does a life insurance payout take for funeral or cremation expenses?

Many claims are paid within weeks once the beneficiary submits a complete claim, but timelines vary by insurer and circumstances. A practical benchmark from Aflac is that life insurers typically take 14 to 60 days to pay out after a beneficiary files a claim. Missing documents, beneficiary questions, or additional review can extend that timeline.

-

What is an assignment of benefits to a funeral home, and is it the same as making the funeral home the beneficiary?

An assignment typically authorizes the insurer to pay the funeral home directly for some or all funeral expenses, while the beneficiary remains the beneficiary. It is usually not the same as changing the beneficiary designation, and the insurer still must approve the claim before paying.

-

Do I need a death certificate to file a life insurance claim?

In most cases, yes. The NAIC notes that to claim the benefit you’ll need a copy of the death certificate. Insurers often require certified copies, so it can help to request multiple certified death certificates early.

-

What if we can’t find the life insurance policy paperwork?

You can search for clues through bank statements, employer benefits, or an insurance agent, and the NAIC’s Life Insurance Policy Locator may help identify coverage. NAIC notes that searches through the locator may take 90 business days or more, so you may still need another plan for immediate cremation expenses while you wait.

-

Can policy loans reduce the life insurance payout we expected to use for cremation?

Yes, it can happen with certain permanent policies. The NAIC explains that unpaid loans (plus interest) are subtracted from the death benefit, which means the amount paid to beneficiaries can be lower than the face amount of the policy.