In the first days after someone dies, the internet doesn’t stop. Bills keep charging. Two-factor codes keep arriving. A phone keeps lighting up with reminders that feel both practical and painfully personal. Many families are surprised by how quickly a loss becomes a question of access: How do we get into the email account that holds every receipt and confirmation? How do we preserve the photos in the cloud? How do we stop the subscriptions that will quietly renew next week?

This is where a digital executor—sometimes called a digital personal representative—can make the difference between a steady process and months of unnecessary stress. The role is not about “hacking” or bypassing security. It’s about managing a loved one’s online life responsibly, within the limits of the law and each platform’s policies, while protecting their privacy and your family’s time.

If you’re planning ahead, you can treat this as a gift you leave behind: a clear digital legacy plan and a realistic digital assets checklist your family can follow when they’re exhausted. If you’re here because someone has already died, you can still take a calm, methodical approach that reduces lockouts and regret—and helps you manage online accounts after death without guessing.

What a digital executor is (and what it isn’t)

A digital executor is the person you trust to handle your digital life after you die: email, cloud storage, devices, subscriptions, social accounts, and any online financial or business accounts. In some estates, this person is the same as the executor named in the will. In others, the “digital executor” is an informal helper who works alongside the executor—especially if the official executor is not comfortable with technology.

What the role isn’t: it isn’t automatic access to passwords or private messages. Most platforms are designed to protect user privacy even after death, which means they often won’t share login credentials with anyone. For example, Google states that it cannot provide passwords or other login details for a deceased user, even when family members or representatives submit requests. If content is shared at all, it is handled through a formal process and only in certain circumstances. That guidance is outlined in Google’s support resources on deceased-user requests and account handling: Submit a request regarding a deceased user's account.

If you want a practical overview of what families typically do, Funeral.com’s guide to digital estate planning helps you think through the categories that matter most—without turning your life into a complicated system no one maintains.

Why the law matters: authority, privacy, and platform rules

Even when a family has good intentions, “we need to log in” can run directly into legal limits. Many states follow frameworks influenced by the Revised Uniform Fiduciary Access to Digital Assets Act (often abbreviated as RUFADAA), which is intended to clarify how fiduciaries—executors, trustees, agents under power of attorney—may access certain digital assets and communications, and under what conditions. A useful starting point for understanding the concept and terminology is the Uniform Law Commission’s overview of the act and its purpose: Revised Uniform Fiduciary Access to Digital Assets Act (RUFADAA).

In plain language, authority matters. The best-case scenario is not “someone knows the passcode.” The best-case scenario is “the right person has legal authority, the right documentation, and the platform’s required tools were set up in advance.” That combination tends to reduce conflicts, delays, and accusations of improper access—especially when there are multiple relatives involved.

What the role typically covers in real life

When families imagine a digital executor, they often picture social media. In practice, the role usually starts earlier and quieter: the phone number, the primary email account, and the devices that act as keys to everything else. A digital executor’s responsibilities usually fall into four overlapping buckets—protect, preserve, close, and hand off.

Protect means stabilizing access and preventing identity theft or unauthorized changes. Preserve means saving what matters—photos, messages, documents—before accounts are deleted or devices are wiped. Close means stopping recurring charges and shutting down accounts that should not remain active. Hand off means transferring what should continue: a family photo archive, a domain name for a small business, or a subscription that can legally be moved to another household member.

For a practical workflow families can follow without trying to do everything at once, Funeral.com’s digital accounts closure checklist is designed around the order that tends to reduce lockouts and prevent accidental loss of data.

The hard truth about “executor password access”

Many people assume that if a loved one named them in a will, platforms will simply hand over the login. That’s rarely how it works. Most platforms treat passwords as non-transferable and protect them as part of account security. Even when access is granted, it is often granted through a tool the account owner set up while alive, or through a legal request process that provides limited data.

Two examples illustrate the difference between “access” and “passwords.”

Apple provides a formal process for requesting access to a deceased person’s Apple Account data, and it also offers an option to set up a Legacy Contact in advance. Apple’s support documentation explains both the request process and how Legacy Contact access works, including the importance of the access key and required documentation: How to request access to a deceased family member’s Apple Account and How to add a Legacy Contact for your Apple Account.

Google offers an “Inactive Account Manager” feature that allows a user to decide what happens to their account data after a period of inactivity. Google’s own overview explains that it is designed to share parts of account data or notify trusted contacts if the account becomes inactive: About Inactive Account Manager.

Notice what both approaches have in common: they work best when set up ahead of time, and they are designed to protect privacy. A good digital legacy plan doesn’t pretend those limits don’t exist. It works with them.

A calm order of operations for families

When you’re grieving, the biggest risk is not that you “do it wrong.” The biggest risk is that you do something irreversible too early—disconnect the phone number that receives verification codes, wipe a device that contains the only copy of family photos, or close the email account that all other accounts rely on for password resets.

If you need a steady sequence you can return to over time, this order is usually safer than trying to close accounts at random:

- Secure the devices: locate the phone(s), laptop(s), tablets, and any security keys. Keep them charged and stored safely.

- Protect the phone number first: a phone line is often the key to two-factor authentication. If you need help deciding whether to cancel or transfer service, Funeral.com’s guide on canceling or transferring a cell phone plan after a death explains why “waiting to cancel” can be risk management, not procrastination.

- Stabilize the primary email account: nearly every account ties back to email for receipts, confirmations, and password resets.

- Locate the password manager or vault: if one exists, it can act as a map. If it doesn’t, you’ll build an inventory the slow way—by checking email confirmations, bank statements, app subscriptions, and saved logins.

- Preserve what’s sentimental before you close anything: photos, videos, messages, and notes often matter more than the account itself.

- Stop recurring charges: prioritize subscription cancellation after death for anything tied to credit cards, PayPal, app stores, or auto-renewals.

- Close or memorialize accounts thoughtfully: when you’re ready, decide what should be deleted, what should be archived, and what should remain as a memorial.

If you want a supporting system for the non-digital paperwork that tends to sit alongside these tasks, Funeral.com’s funeral and cremation document folder checklist pairs well with digital estate work because it keeps proof and permissions in one place.

A digital assets checklist you can attach to your estate plan

Families often ask for a list that is detailed enough to be useful, but not so complicated that no one updates it. The checklist below is designed to be something you can attach to your estate plan as a living document—a digital assets checklist that is easy to revisit once or twice a year.

- Devices and passcodes: phone, laptop, tablet, external drives, and any device passcodes; note where devices are stored.

- Primary email: the email address that receives bills, confirmations, and password resets; note any recovery email/phone if appropriate.

- Password manager or vault: name of the tool and how emergency access is granted; note where recovery codes are stored.

- Cloud storage and backups: iCloud, Google Drive, Dropbox, OneDrive; where photos and documents live.

- Photos and message archives: what should be preserved (family photos, voice messages, texts) and where backups should be saved.

- Financial logins: bank portals, credit cards, PayPal, payment apps, investment logins; include “where statements arrive” if that is easier than listing credentials.

- Subscriptions and recurring charges: streaming, software, cloud storage upgrades, app subscriptions, newsletters with paid tiers; note which are essential to keep temporarily.

- Social media: what you want done—memorialize, delete, or leave untouched; include any “do not post” preferences.

- Utilities and household accounts: accounts connected to a home (internet, phone plans, shared streaming) that may need transfer rather than cancellation.

- Online business assets: domains, website hosting, e-commerce platforms, creator accounts, ad revenue accounts; who should take over, if anyone.

- Loyalty and rewards: airline miles, hotel points, store rewards, gift card balances; note which are meaningful and which can be ignored.

- Instructions for the digital executor: what to preserve first, what can be closed quickly, and what decisions should be made with the family.

If you want to build this checklist into a safer system, Funeral.com’s guide on storing passwords and digital legacy details focuses on realistic setups families actually maintain—especially the “digital vault plus a small offline backup” approach that reduces single points of failure.

Where this fits into funeral planning and cremation decisions

It can feel strange to talk about online accounts in the same conversation as memorial decisions, but this is what modern loss looks like. Digital estate work often happens alongside funeral planning, and the choices you make in one area affect the other. If you are handling arrangements, you may also be answering questions like how much does cremation cost or what your family wants to do with the ashes—questions that are increasingly common because cremation is now the majority choice in the United States.

According to the National Funeral Directors Association, the U.S. cremation rate is projected to be 63.4% in 2025, and the organization projects the rate will continue rising over time. The Cremation Association of North America reports a 61.8% U.S. cremation rate in 2024 and publishes annual statistics and projections. Those trends matter because cremation often creates more flexibility around timing, travel, and memorialization—sometimes allowing families to handle urgent “access” issues first and plan a ceremony when they have more breath.

On the practical side, cremation also creates decisions about containers and keepsakes. If you are choosing cremation urns, it can help to start broad and then narrow by plan. Many families begin by browsing cremation urns for ashes, then decide whether they need a full-size urn, small cremation urns for partial remains, or keepsake urns for sharing among relatives. If you want a calmer decision process, Funeral.com’s guide on how to choose a cremation urn walks through sizing, materials, and what to ask before you buy.

For many families, the most emotionally loaded question isn’t “which urn,” but keeping ashes at home: whether it will feel comforting or heavy over time, how to place an urn safely, and how to make a home memorial that feels respectful. If that is your situation, Funeral.com’s guide on keeping ashes at home can help you think through the practical and emotional fit.

And when families ask what to do with ashes, the answer is often more than one thing: keep some, share some, scatter some, or plan a cemetery placement later. If you want ideas that cover both traditional and modern approaches, Funeral.com’s guide on what to do with ashes includes options for home memorials, sharing, and scattering.

If your plan includes water burial or burial at sea, the container requirements change, and families often prefer to plan that moment with extra clarity. Funeral.com’s guide on water burial planning explains what “three nautical miles” means and why biodegradable container choices matter.

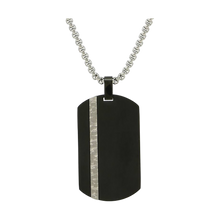

For families who want something wearable and private, cremation jewelry can be a gentle option—especially when an urn feels too visible. If you’re exploring cremation necklaces, you can browse cremation necklaces and read Funeral.com’s guide to cremation jewelry basics, including what to look for in closures and filling methods.

And because grief is not limited to human loss, many digital executor tasks also show up after pet loss—especially when families are closing subscriptions, updating accounts, and trying to preserve photos. If you are choosing pet urns or pet urns for ashes, Funeral.com’s collections for pet cremation urns, pet figurine cremation urns, and pet keepsake cremation urns are designed to support different memorial styles—shared keepsakes, figurine tributes, and more traditional urn designs.

When families are budgeting, the question how much does cremation cost is often tied to decisions about whether a service will be held at a funeral home, at home, or later. NFDA reports median costs for funeral options, including a funeral with cremation, on its statistics page, which can help families anchor expectations. If you want a plain-language breakdown that separates “cremation provider costs” from “urn and memorial choices,” Funeral.com’s guides on average funeral and cremation costs and urn and cremation cost breakdown can help you compare options without feeling pressured.

Choosing the right person to serve as your digital executor

The “right” digital executor is not always the most tech-savvy person in the family. It is the person who can be trusted with privacy, who can communicate calmly with relatives, and who can follow a process without improvising. In many families, the best fit is someone who is steady and organized, even if they need to look up the steps.

It also helps to choose someone who can tolerate ambiguity. Digital estate work often involves waiting for death certificates, dealing with customer support, and accepting that some accounts will never be fully accessible without the account owner’s prior setup. A good digital personal representative can hold that reality without turning it into conflict.

If you want to make the role easier on the person you choose, consider leaving them a short “map” that points to where the information is stored rather than a file full of passwords. That approach tends to stay safer and more maintainable over time.

How to document access safely without creating new risk

Many people try to solve this by printing a password list and putting it in a drawer. The problem is that drawers are not secure, passwords change, and a printed list can become dangerous if it’s found by the wrong person. On the other hand, refusing to document anything often leaves families locked out of what matters most.

A realistic middle path is to document the system, not the secrets. Write down what tools you use (password manager name, where recovery codes are stored, who has emergency access), identify your primary email account and phone number, and leave clear instructions for your digital executor about what should be preserved and what should be closed. Funeral.com’s guide on how families store passwords and digital legacy details is built around this “boring but stable” approach.

If you want this to connect cleanly to the rest of your estate plan, Funeral.com’s end-of-life planning checklist ties together documents, conversations, and digital account preparation in one place—so your family isn’t forced to assemble the puzzle while grieving.

Frequently asked questions

-

Is a digital executor the same as the executor in a will?

Sometimes. In many estates, the executor handles everything, including digital accounts. In other families, the executor appoints a trusted helper to handle digital tasks because the work requires a specific kind of patience and familiarity with devices, logins, and customer support processes. The most important piece is authority: the person doing the work should be acting with the knowledge and permission of the estate’s legal representative.

-

Can a digital executor get passwords after someone dies?

Typically, no. Most platforms will not provide passwords or login credentials to anyone. Some platforms may provide limited access to data through formal processes, or through tools the person set up while alive (such as legacy access features). Google explicitly notes that it cannot provide passwords or other login details for a deceased user.

-

What is the best way to set up legacy access for Apple and Google?

For Apple, consider setting up a Legacy Contact and securely sharing the access key so your chosen person can request access with the required documentation. For Google, consider using Inactive Account Manager to decide what data can be shared and with whom after inactivity. Both tools work best when configured in advance.

-

Should families delete social accounts or memorialize them?

There is no universal “right” answer. Some families find memorial pages comforting; others want closure. What matters is aligning the choice with the person’s preferences and the family’s wellbeing, while preserving photos and messages first. If you need help thinking it through, Funeral.com’s guide to memorializing a loved one on social media walks through practical options and privacy considerations.

-

How long does it usually take to handle digital accounts after a death?

Most families handle the highest-urgency items first—securing devices, protecting the phone number, stopping major recurring charges—then return to lower-urgency accounts over weeks or months. The timeline often depends on how quickly death certificates arrive and whether legacy tools were set up in advance. The work is easier when the goal is progress, not perfection.